Time Series Forecasting

Time Series is a big component of our everyday lives. They are in fact used in medicine (EEG analysis), finance (Stock Prices) and electronics (Sensor Data Analysis). Many Machine Learning models have been created in order to tackle these types of tasks, two examples are ARIMA (AutoRegressive Integrated Moving Average) models and RNNs (Recurrent Neural Networks).

Data Source

For Time series analysis, we are going to deal with Stock market Analysis. This dataset is based US-based stocks daily price and volume data. Dataset taken for analysis is IBM stock market data from 2006-01-01 to 2018-01-01.

Below are the key fields in the dataset:

Date, Open, High, Low, Close, Volume, Name

import warnings

warnings.filterwarnings('ignore')

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

from pandas.plotting import lag_plot

from statsmodels.tsa.stattools import adfuller

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

from statsmodels.tsa.arima.model import ARIMA

from sklearn.metrics import mean_squared_error

EDA and Data Wrangling

df = pd.read_csv("IBM_2006-01-01_to_2018-01-01.csv.zip")

print(df.head())

Console output (1/1):

Date Open High Low Close Volume Name

0 2006-01-03 82.45 82.55 80.81 82.06 11715200 IBM

1 2006-01-04 82.20 82.50 81.33 81.95 9840600 IBM

2 2006-01-05 81.40 82.90 81.00 82.50 7213500 IBM

3 2006-01-06 83.95 85.03 83.41 84.95 8197400 IBM

4 2006-01-09 84.10 84.25 83.38 83.73 6858200 IBM

# Cleaning up the data

df.isnull().values.any()

df = df.dropna()

df.shape

Console output (1/1):

(3019, 7)

df.index = pd.to_datetime(df['Date'])

print(df.head())

Console output (1/1):

Date Open High Low Close Volume Name

Date

2006-01-03 2006-01-03 82.45 82.55 80.81 82.06 11715200 IBM

2006-01-04 2006-01-04 82.20 82.50 81.33 81.95 9840600 IBM

2006-01-05 2006-01-05 81.40 82.90 81.00 82.50 7213500 IBM

2006-01-06 2006-01-06 83.95 85.03 83.41 84.95 8197400 IBM

2006-01-09 2006-01-09 84.10 84.25 83.38 83.73 6858200 IBM

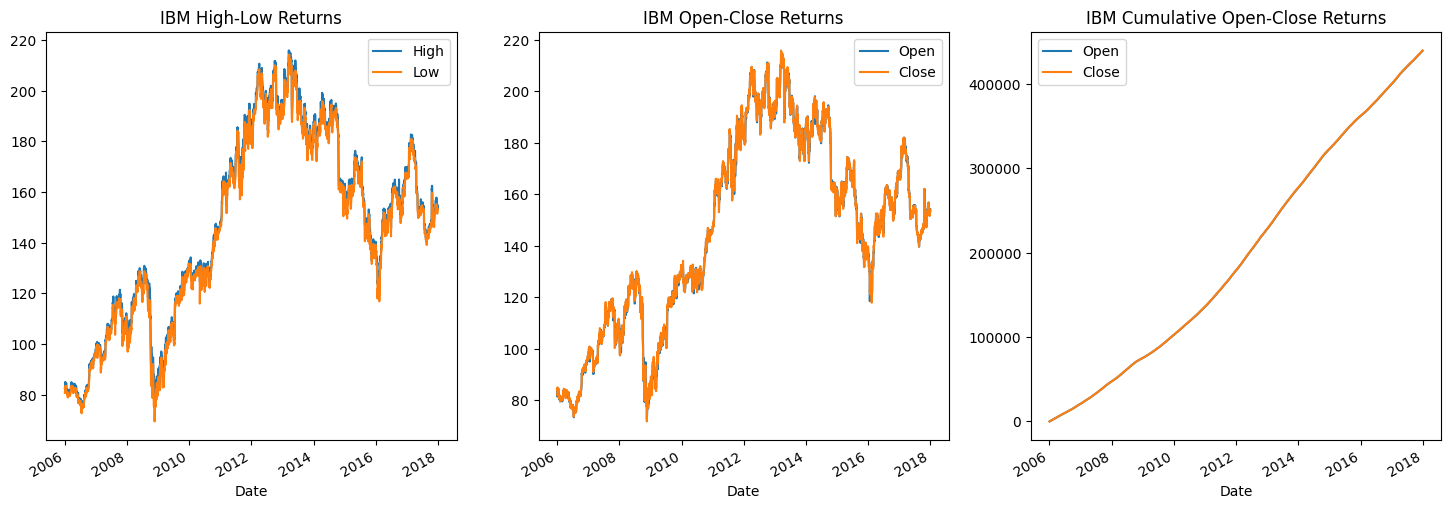

Visualization

fig, axes = plt.subplots(1, 3, figsize=(18, 6))

dr = df[['High', 'Low']]

dr.plot(ax=axes[0])

axes[0].set_title('IBM High-Low Returns')

dr = df[['Open', 'Close']]

dr.plot(ax=axes[1])

axes[1].set_title('IBM Open-Close Returns')

dr = df.cumsum()[['Open', 'Close']]

dr.plot(ax=axes[2])

axes[2].set_title('IBM Cumulative Open-Close Returns')

plt.show()

Console output (1/1):

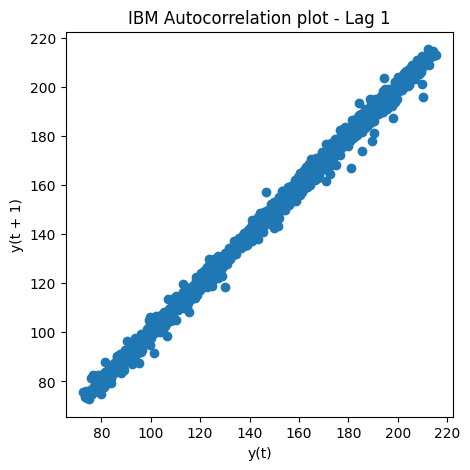

Autocorrelation plot

plt.figure(figsize=(5,5))

lag_plot(df['Open'], lag=1)

plt.title('IBM Autocorrelation plot - Lag 1')

plt.show()

Console output (1/1):

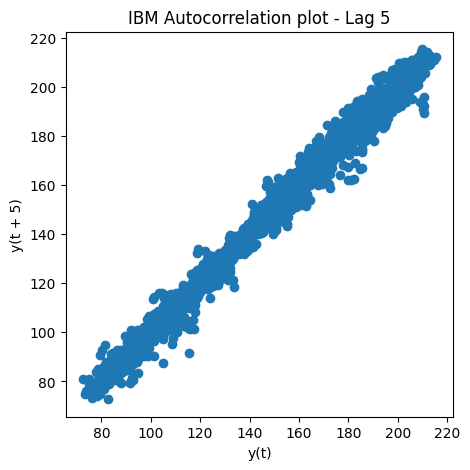

Visualize the Auto-Correlation plot for IBM Open prices with Lag 5

plt.figure(figsize=(5,5))

lag_plot(df['Open'], lag=5)

plt.title('IBM Autocorrelation plot - Lag 5')

plt.show()

Console output (1/1):

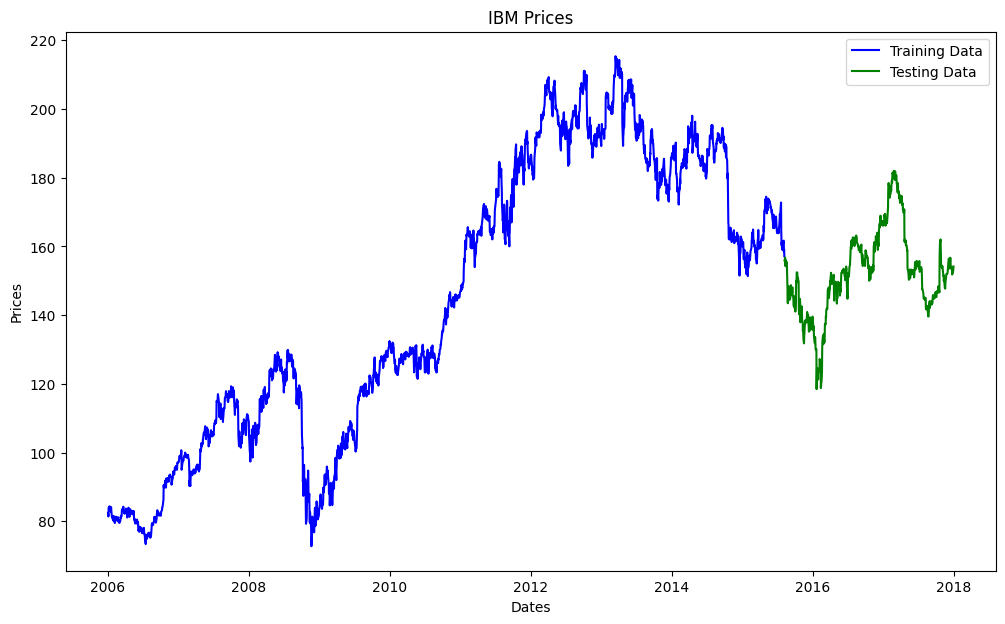

def plot_ibm_prices(train_data, test_data):

"""

Plots the training and testing data for IBM stock prices.

Args:

train_data (pd.DataFrame): A DataFrame containing the training data.

test_data (pd.DataFrame): A DataFrame containing the testing data.

"""

fig, ax = plt.subplots(figsize=(12, 7))

ax.set_title('IBM Prices')

ax.set_xlabel('Dates')

ax.set_ylabel('Prices')

ax.plot(train_data['Open'], 'blue', label='Training Data')

ax.plot(test_data['Open'], 'green', label='Testing Data')

ax.legend()

plt.show()

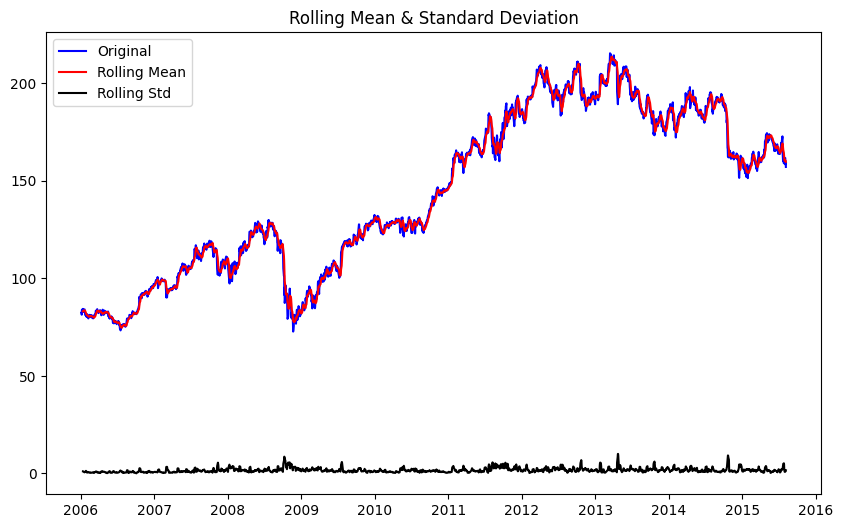

def plot_rolling_statistics(train_series, window=7):

"""

Plots the rolling mean and standard deviation for a time series.

Args:

train_series (pd.Series): A Series containing the time series data.

window (int): The window size for the rolling statistics.

"""

# Determine rolling statistics

rolmean = train_series.rolling(window).mean()

rolstd = train_series.rolling(window).std()

# Plot rolling statistics

fig, ax = plt.subplots(figsize=(10, 6))

orig = ax.plot(train_series, color='blue', label='Original')

mean = ax.plot(rolmean, color='red', label='Rolling Mean')

std = ax.plot(rolstd, color='black', label='Rolling Std')

ax.legend(loc='best')

ax.set_title('Rolling Mean & Standard Deviation')

plt.show()

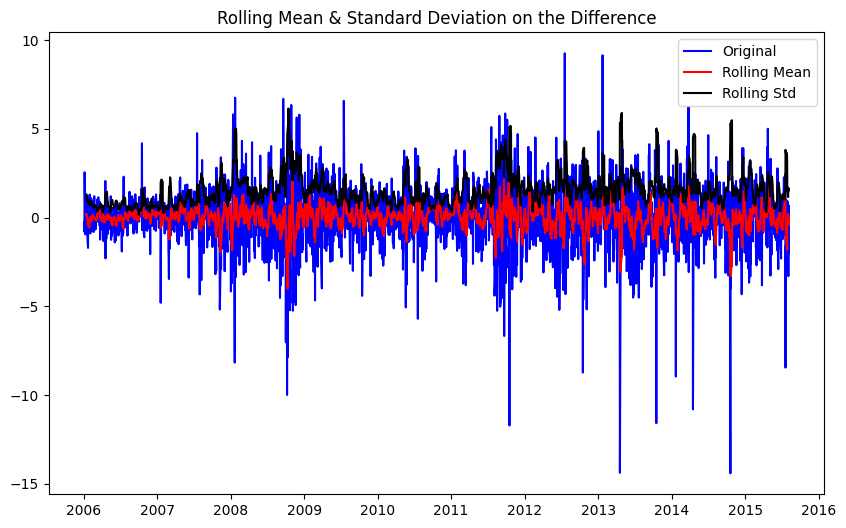

def plot_rolling_statistics_diff(train_diff, window=7):

"""

Plots the rolling mean and standard deviation for a differenced time series.

Args:

train_diff (pd.Series): A Series containing the differenced time series data.

window (int): The window size for the rolling statistics.

"""

# Determine rolling statistics

rolmean = train_diff.rolling(window).mean()

rolstd = train_diff.rolling(window).std()

# Plot rolling statistics

fig, ax = plt.subplots(figsize=(10, 6))

orig = ax.plot(train_diff, color='blue', label='Original')

mean = ax.plot(rolmean, color='red', label='Rolling Mean')

std = ax.plot(rolstd, color='black', label='Rolling Std')

ax.legend(loc='best')

ax.set_title('Rolling Mean & Standard Deviation on the Difference')

plt.show()

Splitting into testing and training data

train_data, test_data = df.iloc[0:int(len(df)*0.8), :], df.iloc[int(len(df)*0.8):, :]

plot_ibm_prices(train_data, test_data)

Console output (1/1):

Performing ARIMA (AutoRegressive Integrated Moving Average)

window = 7

train_series = train_data['Open']

plot_rolling_statistics(train_series, window)

Console output (1/1):

Next we will calculate the Augmented Dickey-Fuller test for stationarity of a time series data train_series. The adfuller() function from the statsmodels.tsa.stattools module is used for this purpose, with the autolag parameter set to ‘AIC’ to automatically select the best lag order for the test.

dftest = adfuller(train_series, autolag='AIC')

dfoutput = pd.Series(dftest[0:4], index=['Test Statistic','p-value','#Lags Used','Number of Observations Used'])

for key,value in dftest[4].items():

dfoutput['Critical Value (%s)'%key] = value

dfoutput

Console output (1/1):

Test Statistic -1.487786

p-value 0.539545

#Lags Used 7.000000

Number of Observations Used 2407.000000

Critical Value (1%) -3.433070

Critical Value (5%) -2.862742

Critical Value (10%) -2.567410

dtype: float64

Observation:

p-value is not less than 0.05, series is not stationary.

Apply a first order differencing on the training data

train_diff = train_series.diff()

train_diff = train_diff.dropna(inplace = False)

plot_rolling_statistics_diff(train_diff, window=7)

Console output (1/1):

AD-Fuller Stats for differenced train data

dftest = adfuller(train_diff, autolag='AIC')

dfoutput = pd.Series(dftest[0:4], index=['Test Statistic','p-value','#Lags Used','Number of Observations Used'])

for key,value in dftest[4].items():

dfoutput['Critical Value (%s)'%key] = value

dfoutput

Console output (1/1):

Test Statistic -20.324277

p-value 0.000000

#Lags Used 6.000000

Number of Observations Used 2407.000000

Critical Value (1%) -3.433070

Critical Value (5%) -2.862742

Critical Value (10%) -2.567410

dtype: float64

After differencing, the p-value is extremely small. Thus this series is very likely to be stationary.

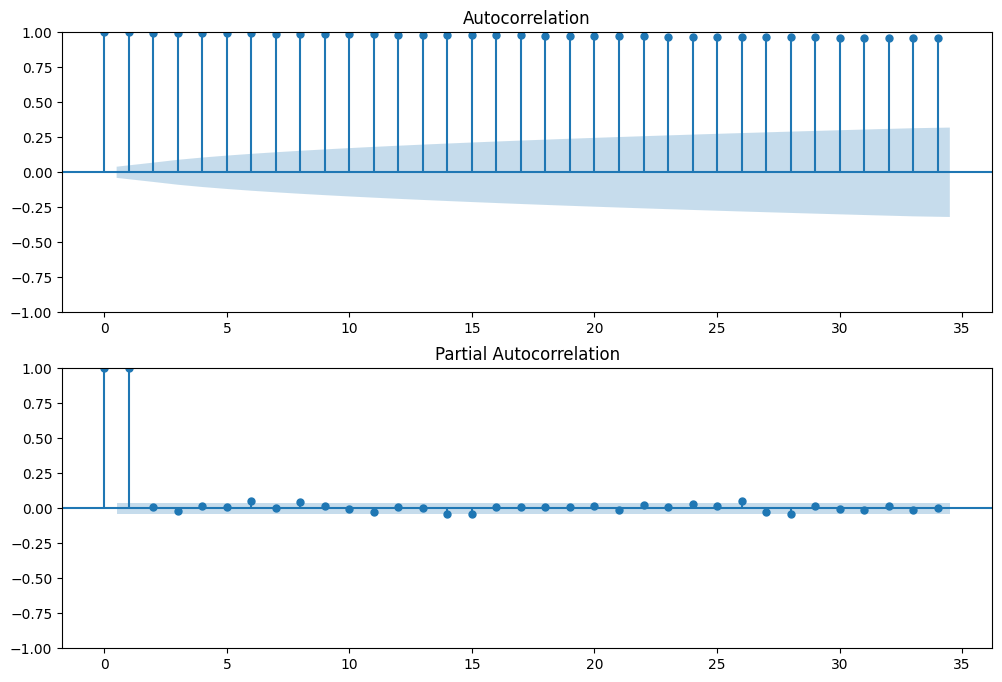

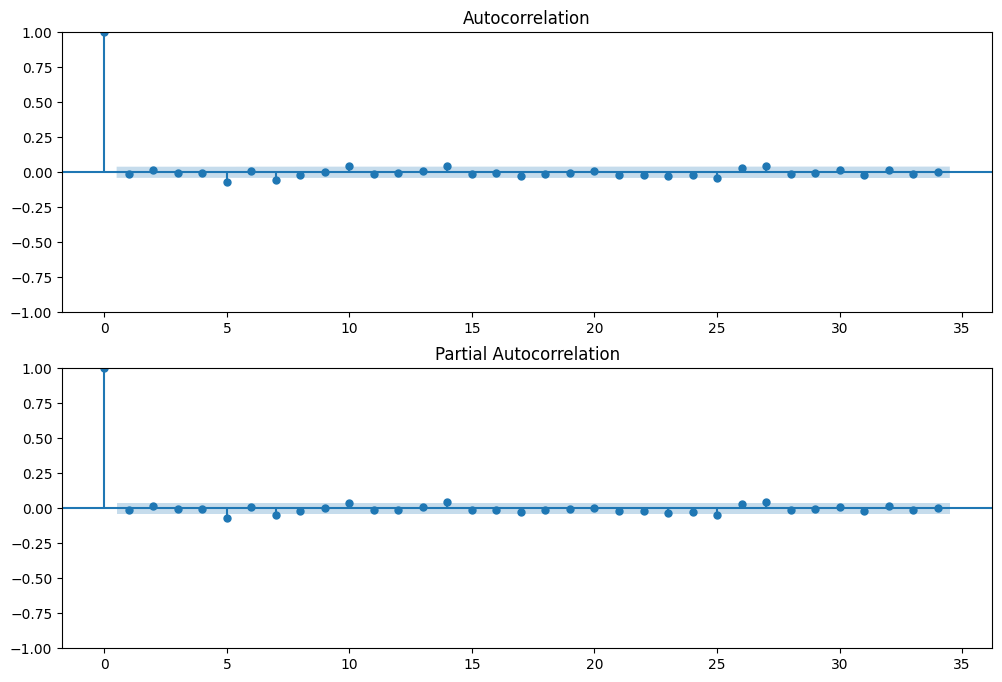

Plot ACF and PACF on the original train series

fig, ax = plt.subplots(2, 1, figsize=(12,8))

plot_acf(train_series, ax=ax[0]); #

plot_pacf(train_series, ax=ax[1])

plt.show()

Console output (1/1):

Plot ACF and PACF on the differenced train series

fig, ax = plt.subplots(2, 1, figsize=(12,8))

plot_acf(train_diff, ax=ax[0]); #

plot_pacf(train_diff, ax=ax[1])

plt.show()

Console output (1/1):

Determininig p, d, q

- p=5

- d=1

- q=0

def smape_kun(y_true, y_pred):

"""

Computes the symmetric mean absolute percentage error (SMAPE) between two arrays.

Args:

y_true (np.array): An array of ground truth values.

y_pred (np.array): An array of predicted values.

Returns:

float: The SMAPE between `y_true` and `y_pred`.

"""

# Compute SMAPE

return np.mean((np.abs(y_pred - y_true) * 200 / (np.abs(y_pred) + np.abs(y_true))))

test_series = test_data['Open']

test_diff = test_series.diff()

test_diff = test_diff.dropna(inplace = False)

%%time

history = [x for x in train_diff]

predictions = list()

for t in range(len(test_diff)):

# initialize the model with history and right order of parameters

model = ARIMA(history, order=(5,1,0))

# fit the model

model_fit = model.fit()

# use forecast on the fitted model

output = model_fit.forecast()

yhat = output[0]

predictions.append(yhat)

obs = test_diff[t]

history.append(obs)

if t % 100 == 0:

print('Test Series Point: {}\tPredicted={}, Expected={}'.format(t, yhat, obs))

Console output (1/1):

Test Series Point: 0 Predicted=-0.5229671125021065, Expected=0.8800000000000239

Test Series Point: 100 Predicted=0.5049973042749393, Expected=-0.5100000000000193

Test Series Point: 200 Predicted=0.035878315975330644, Expected=2.0500000000000114

Test Series Point: 300 Predicted=-0.3784100169699953, Expected=-0.020000000000010232

Test Series Point: 400 Predicted=-0.7058202182006886, Expected=-0.36000000000001364

Test Series Point: 500 Predicted=-0.29631462259624564, Expected=0.5699999999999932

Test Series Point: 600 Predicted=-0.22433188016459504, Expected=0.4399999999999977

CPU times: user 2min 2s, sys: 4min 9s, total: 6min 12s

Wall time: 1min 34s

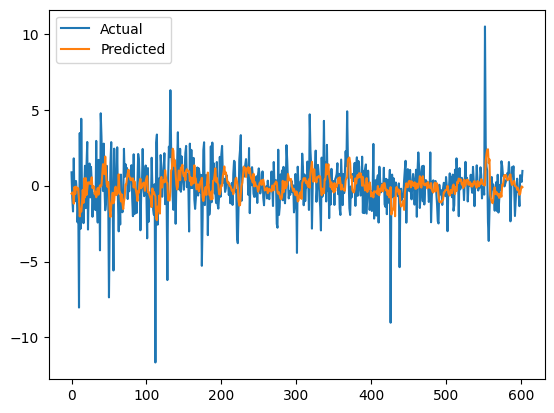

# plot actual values

plt.plot(test_diff.values, label='Actual')

# plot predicted values

plt.plot(predictions, label='Predicted')

plt.legend()

plt.show()

Console output (1/1):

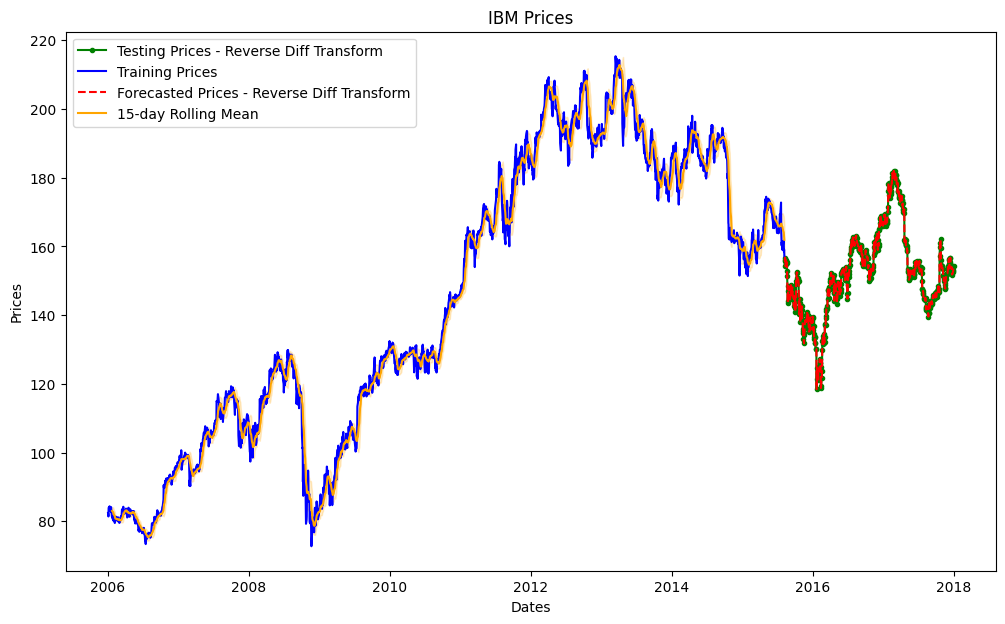

Reverse Transform the forecasted values

Since we used differencing of the first order in the series before training, we need to reverse transform the values to get meaningful price forecasts.

reverse_test_diff = np.r_[test_series.iloc[0], test_diff].cumsum()

reverse_predictions = np.r_[test_series.iloc[0], predictions].cumsum()

reverse_test_diff.shape, reverse_predictions.shape

Console output (1/1):

((604,), (604,))

Evaluate model performance

error = mean_squared_error(reverse_test_diff, reverse_predictions)

print('Testing Mean Squared Error: %.3f' % error)

error2 = smape_kun(reverse_test_diff, reverse_predictions)

print('Symmetric Mean absolute percentage error: %.3f' % error2)

Console output (1/1):

Testing Mean Squared Error: 17.604

Symmetric Mean absolute percentage error: 2.390

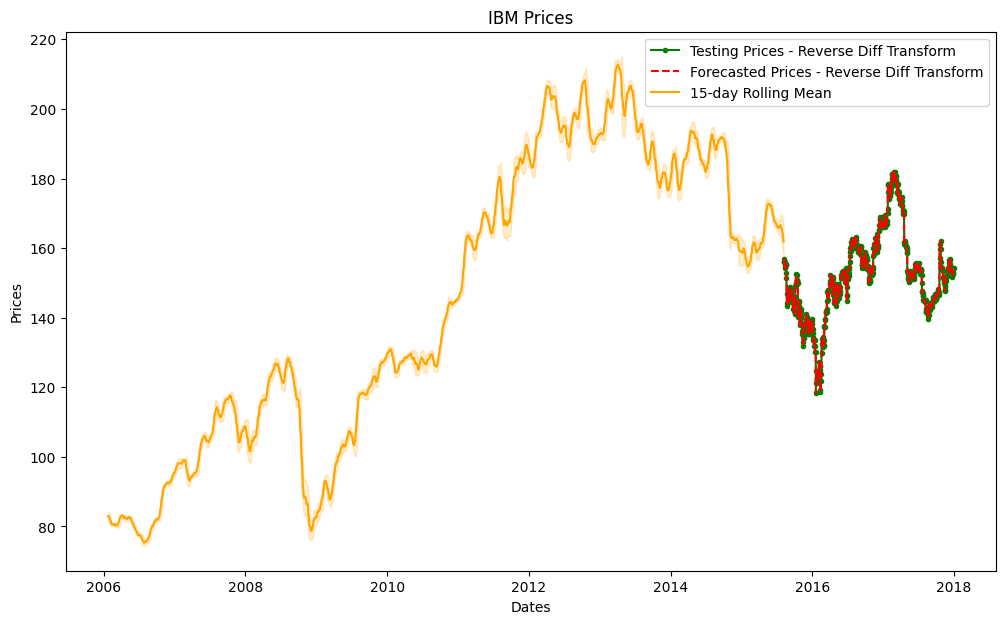

Let’s Visualize the forecast results

def plot_forecast(train_series, reverse_test_diff_series, reverse_forecast_diff_series, window=30, flag=True):

"""

Plots the original and forecasted prices for a time series.

Args:

train_series (pd.Series): A Series containing the training data.

reverse_test_diff_series (pd.Series): A Series containing the testing data, after reversing the differencing.

reverse_forecast_diff_series (pd.Series): A Series containing the forecasted data, after reversing the differencing.

window (int): The size of the rolling window to use for the rolling mean and standard deviation. Default is 30.

"""

# Calculate rolling mean and standard deviation

rolmean = train_series.rolling(window).mean()

rolstd = train_series.rolling(window).std()

# Plot original and forecasted prices

fig, ax = plt.subplots(figsize=(12, 7))

ax.plot(reverse_test_diff_series, color='green', marker='.', label='Testing Prices - Reverse Diff Transform')

if flag:

ax.plot(train_series, color='blue', label='Training Prices')

ax.plot(reverse_forecast_diff_series, color='red', linestyle='--', label='Forecasted Prices - Reverse Diff Transform')

else:

ax.plot(reverse_test_diff_series, color='red', linestyle='--', label='Forecasted Prices - Reverse Diff Transform')

ax.plot(rolmean, color='orange', label=f'{window}-day Rolling Mean')

ax.fill_between(rolstd.index, rolmean-rolstd, rolmean+rolstd, alpha=0.2, color='orange')

ax.set_title('IBM Prices')

ax.set_xlabel('Dates')

ax.set_ylabel('Prices')

ax.legend()

plt.show()

reverse_test_diff_series = pd.Series(reverse_test_diff)

reverse_test_diff_series.index = test_series.index

reverse_predictions_series = pd.Series(reverse_test_diff)

reverse_predictions_series.index = test_series.index

# Plot the forecasted prices

plot_forecast(train_series, reverse_test_diff_series, reverse_predictions_series, window=15)

Console output (1/1):

Visualize only test and forecast prices

plot_forecast(train_series, reverse_test_diff_series, reverse_predictions_series, window=15, flag=False)

Console output (1/1):